Link to site

Let’s talk about a big brand that got it all wrong. A few years ago, I took on a customer segmentation project with a restaurant chain you’ve definitely heard of. They poured millions into TV spots, programmatic media — all the things — using a consumer profile of their invention versus analyzing the reality on paper. They tailored all their creative, marketing, and advertising to this fiction, and were baffled when their revenue plummeted and their ad investments delivered abysmal results.

Why wasn’t their creative breaking through? Why didn’t their 60-second spots, replete with slow-motion close-ups of sizzling burgers and air-tossed fries, bring bodies into booths? Seasoned executives wondered where they’d got it wrong.

This is the moment when you have to question everything. Did they get lazy when creating and updating their personas? Did they allow their bias to infect their marketing to a point where the stench of it had become unbearable? Were their truths actual truths? Or had they become content to remain in their delusion?

Imagine me nodding my head. Picture me kicking their feet under the table to wake them from fantasy land. In marketing, I’ve learned that your outputs are only as good as your inputs. Garbage in, garbage out.

When we analyzed 150,000 pieces of CRM (customer relationship management), email, social media, in-restaurant check size, traffic, and sales data as well as surveying 10,000 people who had visited the chain in the past year, the results were staggering.

As in, get me a defibrillator, stat, staggering. The composition of the chain’s customers didn’t even come close to the customer this brand had invested millions in targeting. In fact, the customer they were targeting had a below-the-floor opinion of the brand and the food.

This well-known restaurant chain had been delivering the wrong message at the wrong time to the wrong customer while the people who actually populated booths went ignored.

It doesn’t matter if you’re a billion-dollar brand or a scrappy start-up — if you plow through your brand and business fundamentals no amount of money you throw at the problem can fix the problem. Think of it as your desire to throw the party of the century in a house missing a roof, floors, plumbing, and electricity. But you have those cute candles and bottles of champagne on ice!

You don’t build your brand by huddling in conference rooms inventing people that don’t exist. You build your brand by getting out of your head, kicking the door open, and doing some actual research.

Today’s consumer is demanding, discerning, skeptical, and they’re increasingly leveraging their communities, tools, and technology to inform their purchase decisions. Now they’re in the driver’s seat because the Internet democratized information and commerce, offering them a proliferation of attractive options.

According to The Harris Poll study, “63 percent of consumers expect personalization as a standard of service.” Your customers want to be recognized and catered to as individuals, not dollars accruing to your bottom line.

Here’s another fact that might send you into a rage rampage — reaching your customer is tougher than ever because they’re switching and using multiple devices and platforms faster than I can type this sentence. And some are utilizing ad blockers and VPNs to control what information they receive and share. In short, customers are more fragmented than ever and they have access to more information and opinions than ever.

We no longer live in an age where brands told you what to think and buy — consumers now dictate the game and how it’s played. Hence why you might be considering torching your hair, the joint, etc.

Customers are your business — without them, you have an expensive hobby. As a marketer or business owner, you need to be a CIA operative when it comes to your customers. You have to know what triggers the need for your product or service, how they search and discover your solution, the expectations they have about your product or service, and which tools they utilize to decide and buy.

You have to decide — based on your brand, values, product, and business model — what groups of people you want to attract and repel. Once you have a clear picture of your target, the sleuthing begins.

I wrote a comprehensive primer on how to unpack your target audience using your existing data mountain and moth-eaten PowerPoints, which you’ve been ignoring. However, marketers often have more sophisticated, nuanced questions that can’t be answered by Omniture. Specific questions about their customers’ wants, needs, brand, product, and price preferences, triggers, pain-points, motivations, influences, consumption habits, buyer behavior, and propensity toward loyalty and brand evangelism.

Enter customer segmentation.

What is customer segmentation?

Customer segmentation is the process of grouping your customers by common attributes or characteristics, which can be demographic or psychographic. The objective is to have a deeper understanding of each segment so you can market and message effectively.

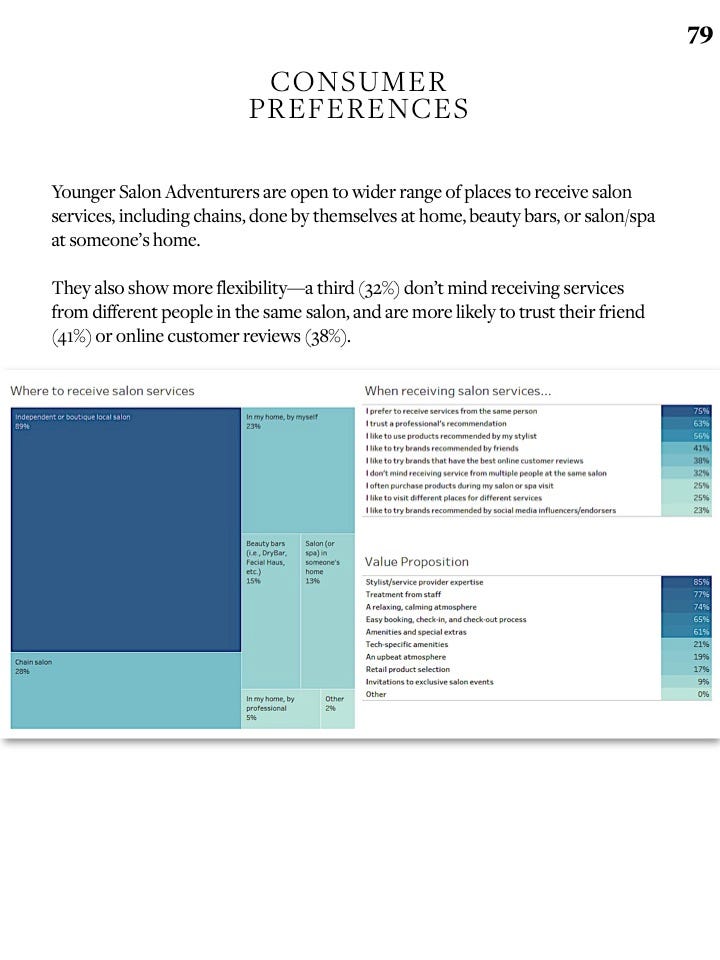

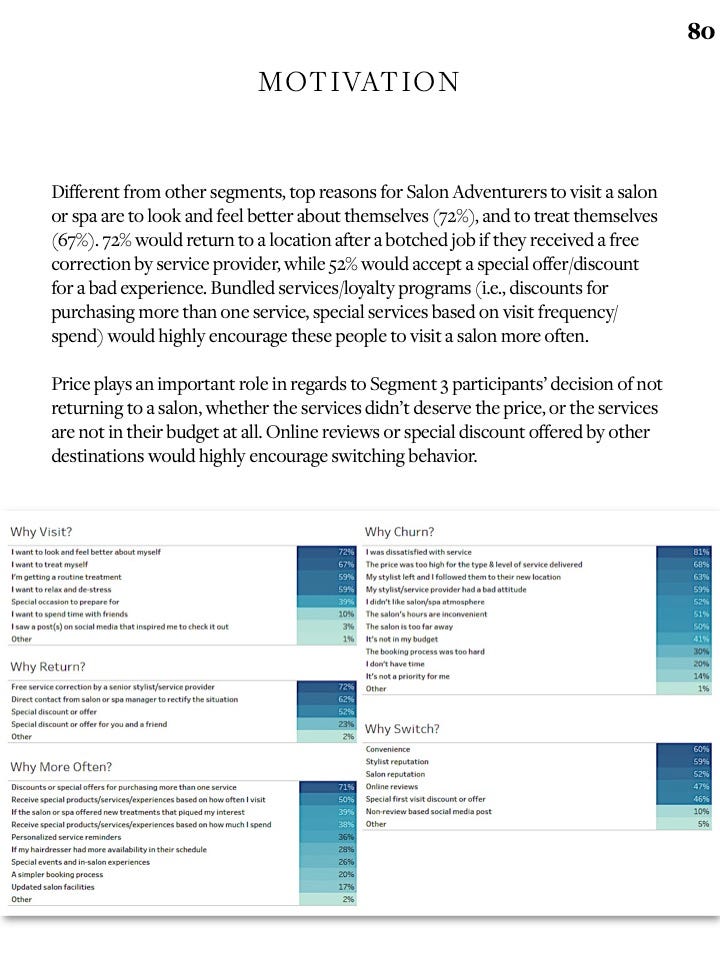

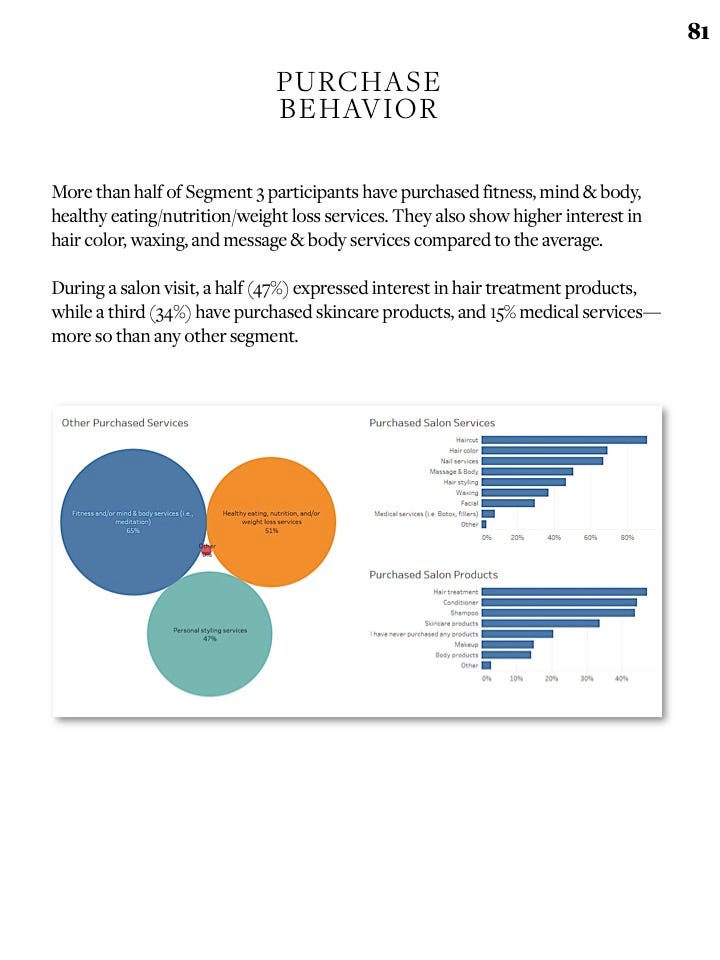

Let me give you an example. This year, I worked on a big project for an upscale salon chain. The client believed that customers exhibited different purchase behaviors based solely on age and income, i.e., an older customer will buy more and expensive services. My initial research posited that wasn’t the case, so we conducted a study of a few thousand women aged 25–65 with a minimum income of $50K/year. Our objective was to surface which attributes predominately create disparate groups of customers within the larger population.

What we found was that women — regardless of age — had very similar preferences, motivations, and behaviors when it came to the salon industry. This actually made it challenging to form distinct segments since women exhibited, generally, similar behaviors.

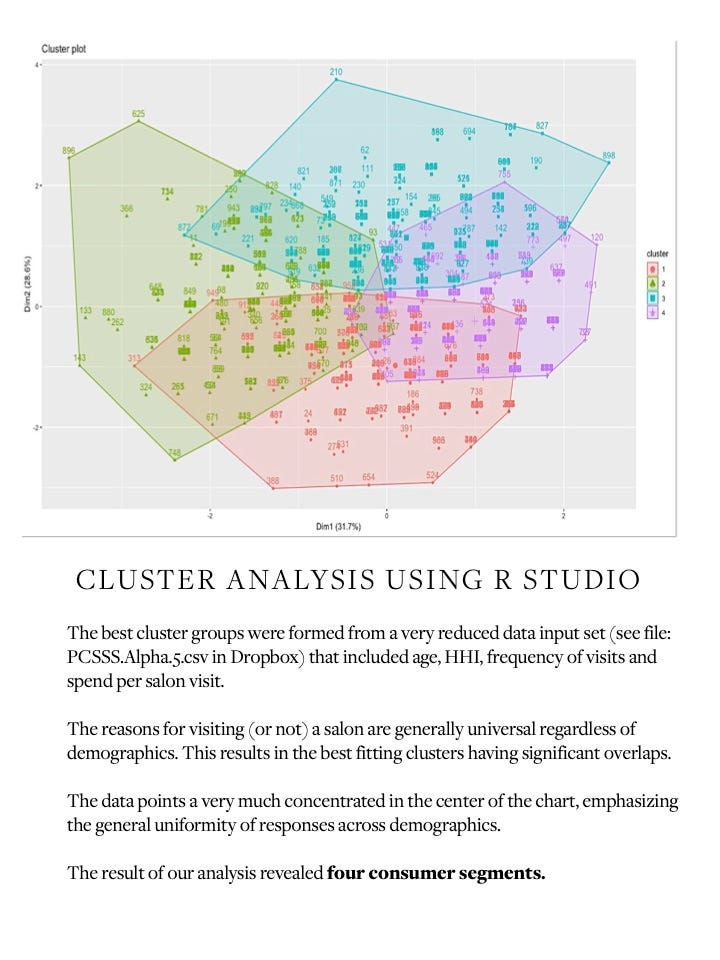

Since there were so many behavioral factors that were universal across demographics, we clustered (i.e., a form of data analysis) using a reduced data set (i.e., smaller pool of survey respondents) where my analyst discovered sizable differences when you combine four factors: age, income, frequency of visits, and spend per visit.

Those four factors allowed me to create four distinct customer segments, two of which were more appealing for this specific client. Below, you’ll see summary slides from one of the preferred segments (from a study that ended up including 200 slides, a data dictionary, and a pile of grey hair on the side of my head).

Traditionally, you can segment audiences four ways: by geography, demographics, behavioral and psychographics (which can include life cycle). However, in my experience, the lines between segmentation types often blur.

People tend to think you can only segment by one demographic characteristic such as generation, income, gender, or geography or by a single psychographic attribute such as purchase frequency, spend propensity, motivation for purchase, etc. You can segment by those factors, but you can also segment by a combination of factors. It all depends on what the data reveals. But we’ll get into all that in a hot minute.

How is a segmentation study different from a “how did I do?” customer survey?

Customer surveys are about customers reacting to their experience with your brand and products or services, and telling you ways in which you can improve. Customer service surveys grade your performance whereas segmentation studies are agnostic.

Customer segmentation studies may or may not include your current customers — but you’re targeting the pool you want to capture. Segmentation is not about getting their feedback on your brand and experience with your product, it’s about your prospects giving you intel on what makes them tick.

Making the case: Why do I need one & how does it benefit me?

How much do you really know about your customers? Are you keeping pace with the tools, resources, and technology they rely on, which probably differed from what they used five years ago? Or, are you like my restaurant chain example, living in a Gabriel García Márquez novel?

Here’s a real fact: 75% of new products fail or miss their revenue targets and profit goals because brands didn’t listen to their customers or make an effort to elicit their feedback. Think of all the tears and cash they could have saved. In Madhavan Ramanujam’s and Georg Tacke’s Monetizing Innovation: How Smart Companies Design the Product Around the Price, the authors and seasoned executives posit,

“The most important [way to avoid product failure] is having in-depth pricing discussions with target customers long before the product development team begins to draw up the engineering plans, and certainly long before any manufacturing resources are committed and configured to building something. Those discussions need to center on determining precisely what features customers truly care about, are willing to pay for, and the price they are willing to pay.Shockingly, 80% of companies don’t have this type of discussion with customers early in product development.”

You need to make sure you know precisely who you’re serving and what they expect of you before, during, after, and between point-of-purchase and in all phases of new product design. Aside from risking epic failure, here are additional segmentation benefits:

- Improve knowledge about your audience to more effectively target, market, message, and retain customers. Translation: Higher CLTV (Customer Lifetime Value) and reduced churn (i.e., when your customers bolt), efficient ROAS (Return on Asset Spend) and ROI (Return on Investment).

- Identify business challenges and product & market opportunities.

- Customize current & future products and services to your targets’ desired preferences and experience.

- Differentiate yourself from competitors.

Who do you involve in the process? Who’s impacted?

From product design and development to website UX and customer service, your findings will have a sweeping impact across your business. Your strategy, marketing, and analytics team will lead the study and disseminate the results with preliminary brainstorming and feedback from key business units.

The results of the study should be shared with each impacted business unit so they can design the next steps they need to take to ensure brand cohesion and consistency, as well as a superior, personalized customer experience. The end goal is to deliver what customers need and expect, when and where they expect it.

Here are some of the departments that potentially could be impacted by the results.

- Strategy & Analytics

- Marketing & PR/Comms

- R&D and Product Development

- Design, UX & CX

- Sales

- IT

- Customer Service

How do I know if I’m ready?

I’m going to repeat the question: How well do you know your customers? Are your marketing campaigns a random pile of tactics thrown into the ether in the hope that something will stick? Are you focus groups composed of your friends and employees instead of actual breathing customers who would be buying your products and telling you how you can be better at what you do?

Be honest with yourself. You’re an ideal candidate for segmentation if:

- You’re facing real and consistent challenges with your product or service, which could be resolved by understanding your customers better.

- You want to seize a larger piece of the pie — there are customers out there who would be receptive to your brand and products, but they’re buying from your competitors and you want increased market share.

- You developed your customer profile in a vacuum or in a conference room. You sketched out your customers’ demographics, psychographics, and buying behavior without looking at any data to validate assumptions or bring you back into the land of reality.

- You have different products or services that serve different groups of people and you want to make sure your marketing and messaging are on point.

- You’d love clarity on creating marketing and messaging campaigns that actually connect with and convert prospects to customers.

What if I don’t have the cash to invest in a study?

People love to make excuses and bypass the hard work to leap after the shiny object. Sometimes, it’s because they don’t want to listen to what their customers have to say because that could potentially mean revisiting a product’s design, manufacturing, and packaging — i.e., gross margin murderers. Or, it could be tough-to-swallow truths about how they run their business and communicate with their customers.

Some founders and marketing executives will spend years and dollars plugging their ears because they’re afraid of what they might hear.

Instead, they will drop $5,000 in Facebook ads because some guru hocking a webinar told them ads were the path to paradise — even if they have no idea who they’re targeting and what messages they want to convey, which costs more over the long haul. Or they’ll pay an influencer to gush over their products in a series of well-lit Instagram videos. But believe me when I say customers aren’t stupid. You might be able to fool them once but trick them and they will talk all over social media until you have to pay a team of people to clean up the mess you started.

If you have a garbage product that your customers are complaining about, no amount of glitter you throw on shit will make it any less shit. I know this because over the course of my career I’ve hauled wheelbarrows of glitter, diversionary confetti, and forget-my-product-blows balloons.

I’ll say this until I’m blue in the face and on the verge of passing out — impatience is expensive. Your desperation for any tactic or shiny object that promises ROI is expensive. Most brands flounder because they fuck up the fundamentals in favor of TikTok, Instagram, or any tool du jour.

But let’s get practical. You can’t expect a Tesla on a Kia budget, and you might not even need a Tesla — depending on the size and scope of your business. A Kia could get the job done.

If you have an engaged email list, you can incentivize them (translation: give them something, not the promise of something) to participate in the survey. Then, you can hire an analyst to run the data and interpret the results. If you have $2,500-$5,000 and an experienced marketer on your team, you can conduct an incredible survey with purchased respondents and you can hire an analyst at $60-$100/hr to analyze the results.

We’re talking maybe $10,000 to change the shape of your business. Perhaps more if you need to bring in a consultant to help you get the job done.

How do I start a study?

Define your objectives

Based on your organization and current state of the business, your objectives could focus on answering strategic decisions about the focus and direction of your brand or business. Or, it could be tactical in nature where you’re zeroing in on designing effective marketing and communications campaigns, operations systems, and refining your products or services.

Know your target audience

You want to clearly and specifically define your dream customer and everything you know about them. I developed an extensive tutorial on defining your core customer, but start off by asking yourself:

- Who’s your ideal customer? Why?

- What are their demographics (depending on your brand and what’s relevant, you can consider: age, gender, marital/parental status, education, employment, geography, income, device ownership, and usage)?

- What event (s) would trigger them to buy your products or services? What pain are they experiencing as a result of not having the product or service?

- What problem do they need to solve?

- What are most of your ideal customers buying? Where’s the demand? Which competitors are they buying from?

- How frequently do they need/use your product?

- How price-sensitive are they? Is price a factor?

- Who (or what) influences their purchase decisions?

- What resources, tools, or technology do they use to help them discover, evaluate, purchase and review products?

- What media do they consume? Get specific.

- What’s their tech IQ? Are they tethered to their phone? Booting up a Commodore PC?

- What do you want your customers to think/feel/do when they engage with your product or service?

- What characteristics of your product do they value? For example, they might care that you’re eco-friendly or your materials are of the highest quality. Or perhaps they care about getting a good deal.

- What kind of transformation do you want them to experience? This could be in the form of practical and/or emotional benefits?

You want to form a general picture of your target customer and determine whether your existing data supports or refutes your assumptions.

Examine existing data

Start by gathering and analyzing your:

- Website traffic/e-commerce analytics: You can get some interesting demographic, behavioral information (i.e., how long they stay on your site or on a particular product or page, their click-path, what they leave in their shopping cart, etc.), and transactional data (i.e., what they buy, how often they buy it, when they buy it — and if this differs by demographic or consumer segments). While you’ll get limited demographic data (e.g., geographic location, age, gender, device usage), you can evaluate how they use your website and what makes them stay or flee. If you have a brick & mortar location, you can utilize data off your internal systems (i.e., inventory management, receipts, etc.) and feedback from your sales associates and staff.

- Social media: Social media gives you both quantitative and qualitative insights. You can glean demographic data from fans and followers from each of the platforms’ analytics suite, however, you can also gather more insightful intel and ethnographic behavior based on how people comment, talk and interact with or about your brand. You have access to not only what they want, but also how they express that want, i.e., the words they use and how they use them. For example, do they speak formally or use slang and emojis? This is powerful because you can employ elements of their language back to them — in a non-creepy, non-try-hard way — in the stories you tell and how, when, and where you distribute them.

- Email marketing: Segmenting your list gives you powerful information about product preferences and buying behavior. Basic marketers blast the same message to all people on one list. Sophisticated marketers slice and dice audiences based on purchase frequency and thresholds, buying behavior, product preference, etc.

- SEM/online ad & re-targeting or any form of paid media campaign data: Paid media will give you a wealth of information including what messages and channels resonate best with your customer driving them to take action.

- Customer satisfaction surveys, customer service reports: Not only do you learn what you’re doing right as a brand and how you can potentially improve, but you’re also gaining vital information about your customers’ pain points and concerns. Knowing what gnaws at them empowers you to proactively address their problems by acknowledging them (I hear you!) and providing solutions. You’d be surprised how “seeing” your customers could impact your brand. For example, 56% of U.S. momsdon’t feel that marketers don’t understand them or even make an effort to understand the complexities of motherhood. Imagine being that one brand who can usurp perception?!

While data is directional and important, it’s not the be-all that pundits would have you believe. Nothing replaces talking to your customers or watching their interactions if you have a brick & mortar. There’s an element of experience in your industry & sector married with observing your customers interact and use your product that augments and refines the data.

The point here is to synch perception and reality and understand the anomalies. Ideally, you want to end up with a data-driven (or at least informed) customer profile and the beginnings of a customer journey map.

Conduct informal, 3rd-party research

Information gives you context, direction, and an informed point of view. It lets you define where you stand and where you fit. Information removes the blindfold from your eyes, so you don’t have to Bird Box your way through the customer definition process.

Back in the day, you paid consulting firms to corral all the research and deliver a neat PowerPoint presentation for the low, low price of $100K. Or you sat for days in the local library or Small Business Association office to gather as much as you could to build a brand. And while you still may be outsourcing your research or doing the literal legwork, the internet and social media give us access to a tsunami of data and resources.

Respected research firms like Pew, IBIS World, Statista, Nielsen, Comscore, and Econsultancy share free industry reports and customer research online; some even offer paid upgrades, for those who want to go deep in their discovery. You can purchase studies in nearly every sector or segment of the population from Forrester, Mintel, and eMarketer, to name a few. You can source information from trade publications, market-specific research outfits, university, and non-profit studies are often free and available online.

All you need is a computer, a WIFI connection, and a Google search to get you started. The objective here is to find research regarding the industry you’re in (which will also include information about customers buying said products) as well as any information about your prospective customer. If you’re targeting single, millennial moms or Gen Alpha, there’s a pile of resources at your proverbial fingertips.

Independent research breathes fresh air into your conference room. It may complement, augment, or add/refute your existing data, but the idea here is to gain internal and external insight so you can make an informed assumption (s) about the people who are buying your products.

Form your hypothesis

Now that you have a pile of paper (virtual or recycled) in front of you, read through everything. Take notes of patterns, words, or themes that consistently pop up. Do you see the beginnings of a segment (s) emerging? Is this segment viable? Does it make sense? Does it align with your objectives?

Don’t let this stump you. The idea here is that you want to go in with a few specific ideas and assumptions about groups of people you want to target and any important characteristics.

Also, there’s no set number of segments. You want to capture the most significant groups of people who would be attracted to your products or services, realizing, of course, that there are outliers. I’ve worked with clients that have had two segments and others who’ve had eight. It all depends on your business, brand, industry, products, and potentially market and geographic factors. You might have a business that serves customers (D2C) and businesses (B2C).

But let’s keep it simple. Simply jot down specific theories about your ideal customer (s) — the research will affirm, refute, or alter your assumptions and segments will emerge from the data.

Conduct your primary research study

Most of the segmentation studies I’ve performed relied on online survey research because you get more data and less bias at an affordable cost. For every study, this is how I get started:

- Map out your methodology and all associated logistics: How will you conduct your research? What form will it take? How will you source participants? How long will it take? I always collaborate with data analysts at each stage of the product because they’ll often give me insight into question formulation and structure, and their preliminary approach to and preferred tools for the study. Below, I’ve pasted an example of a methodology slide I shared with a client (I created a more comprehensive version in MS Word at the onset, which included team members and questions).

- Develop your questions: You want a mixture of closed and open-ended questions so you can get definitive insights with colorful commentary. I try not to pose more than 15 questions (I like to keep it under 10) because there’s always drop-off. I’ve used SurveyMonkey when I collaborated with agencies and on my own because the tool is excellent, proficient, and they give me access to all sorts of quality respondents. Every survey comes with the basic demographics of the respondents so I don’t have to waste questions asking about income and whatnot. Below is an excerpt from a segmentation study I performed to decode the digital behavior of physicians by generation.

Also, based on the package you purchase, their customer service teams will review your questions and approach and give you feedback based on their extensive experience. And no, this isn’t sponsored — it’s one of the few tools I love, use, and pay for with my own money

When you formulate your questions, you’ll notice that some of them will require a “select one” kind of response vs. a click all that apply. I try to mix it up and I’ll often add an option for respondents to enter additional options or notes, which is helpful in getting color commentary and additional insights.

- Conduct your research: Depending on the method you choose, you will coordinate all the pregame logistics and start your study. For example, let’s say you want to survey 10,000 people who have purchased your product in the last six months. You decide to use SurveyMonkey and buy participants based on predefined criteria. The qualifying question for participation will be the screening question, which guarantees all the respondents have purchased the kind of product you’re selling.

Then, you set up your SurveyMonkey profile, coordinate all the related admin and costs, draft your questions and log them into SurveyMonkey, purchase your participant pool and time frame (i.e., start and end date), and you’re off and running.

Analyze the results

Once I receive all my responses, I bring in an analyst to segment the results. I deliver raw data in a CSV or XLS file. And again, most of my analysts appreciate the way SurveyMonkey formats the files, which makes it easier for them to clean the data and run their analysis.

Data analysis might as well be a foreign language to me, but I’ve worked with enough analysts who’ve explained their approach and how they’ve defined segments. Most have employed a k-means cluster analysis, which is a technique that assigns a set of individual people in to groups called “clusters” on the basis of one or more question responses, so that respondents within the same cluster are in some sense closer or more similar to one another than to respondents that were grouped into a different cluster.

There are several options for statistical modeling that can help remove researcher bias in segmentation, identify statistically significant differences across your segments, and assess the size of your customer opportunity more accurately (including K-means/hierarchical clustering and latent class segmentation methods).

The groups are distinctly different from one another based on defined attributes (we don’t know what those attributes will be until we cluster the data — hence, the removal of bias). The results of the cluster analysis will be the determining factor for how we segment our audience to eliminate any bias or instinct — this is a purely scientific, quantitative assessment.

Let’s revisit our salon example. My analyst shared a detailed analysis of the clustering he performed to determine the segments (which I can’t share here for obvious reasons), and I had a second analyst re-run the data for any errors.

The results of the analysis should answer two questions:

- Did they satisfy or reject your assumptions?

- Do you need to revisit your objectives in light of the results?

In this specific case, our assumptions were simplistic and refuted by the results, which represented different groups of people in a more nuanced way. We couldn’t make the case that millennials behaved in X way while Gen-X behaved in Y way because generational behavioral differences shouldn’t be reduced to a stereotype. Same with income. In this example, we actually noticed very similar behavioral patterns between older millennials and younger Gen-X, and patterns based on income were all over the map.

We ended up segmenting based on a combination of demographic and psychographic factors. My analyst let me know that I could’ve also mapped how a few of the respondents’ answers to Google search data because sometimes we say we’d do something when our actions might demonstrate otherwise.

For this example, we also had to revisit our objectives because the client had a specific brand, business, and product strategy based on a discrete set of assumptions on salon behavior and preferences by generation. We needed to overhaul marketing, customer service, product and service offering and how they were packaged and sold, and we also recommended a brand identity overhaul.

In short, we came out with more work than we anticipated, but this work will reap long-term business results.

Not all segmentations are this complex, but they offer you insight that allows you to get super specific about your marketing, messaging, and product development and refinement.

How do I apply the results?

Standout brands tell compelling stories that are targeted in marketing and messaging. When developing messaging for your customers, you lean on copywriters to leverage your positioning, brand rational & emotional benefits to speak to specific customer segments. Messaging is not all about you — it’s about your customer. You address their needs, wants, motivations and pain points head-on, and what you want them to think, feel, and do as a result.

When marketing to your customers, it’s essential to think about targeted marketing — from email segmentation and social media to targeted SEM/re-targeting ads.

Brands need to shift from what you do to how you make your customers feel. It’s not about you talking all about you — it’s all about you talking about them.

Once you receive your findings and know your segments, now the work is methodical. You evaluate each and every aspect of your business using gap analysis, for example— top to bottom — to ensure that you have the right product for the right customer and you’re able to message them at the right time on the right channel. You have to consider everything from your brand’s visual and verbal identity to packaging to website design, navigation, and copy to social media ads to customer service management. Here are some simple examples:

- Your customer is mobile-first. They search, evaluate and buy using their smartphone. Is your website responsive? Have you designed the navigation specifically for a mobile experience?

- Your customer wants brands in your space to be vanguards of safety, comfort, and value. They want to know that you’re reputable, reliable, and here for the long haul. Does your brand speak to those values? Are those values inherent in your website copy and the way your products are positioned and marketed? Are you giving your customers a good deal for their money? Do you know what they even consider to be a fair price?

Your results should inform your marketing strategy and tactics down to audience targeting for re-marketing ads on Google. Your results should be reflected in how and what you communicate to your customers, on what channels, with what frequency. Your results should ensure that their pain points are recognized and solutions addressed in everything from your website and product copy to your packaging.

Segmentation isn’t an academic exercise. It’s not a waste of time, money, and resources because you can’t articulate its ROI to the penny. It’s about you stepping back and realizing that your customers are in the driver’s seat and if you don’t make a point to serve them well, they’ll have no problem opening the passenger door and kicking you out into the road.