Digital is fundamentally changing marketing as we know it. Not long ago, marketers previously viewed digital marketing as simply one category within marketing — one tool of many in the marketer’s kit. Increasingly, perception is shifting to a more holistic view in which all marketing is part of the digital world.

Research conducted by Salesforce clearly establishes that marketers now view digital channels as the cornerstone of their strategy, and many of these channels now anchor marketing functions.

According to the “2015 State of Marketing” report from Salesforce, 45% of marketers plan to shift spending from traditional mass advertising to advertising on digital channels. The 54-page report, based on a survey of over 5,000 marketers in the U.S. and around the world, looks at marketers’ top priorities across all digital channels, and how their budgets, metrics, and strategies are shifting to support their goals.

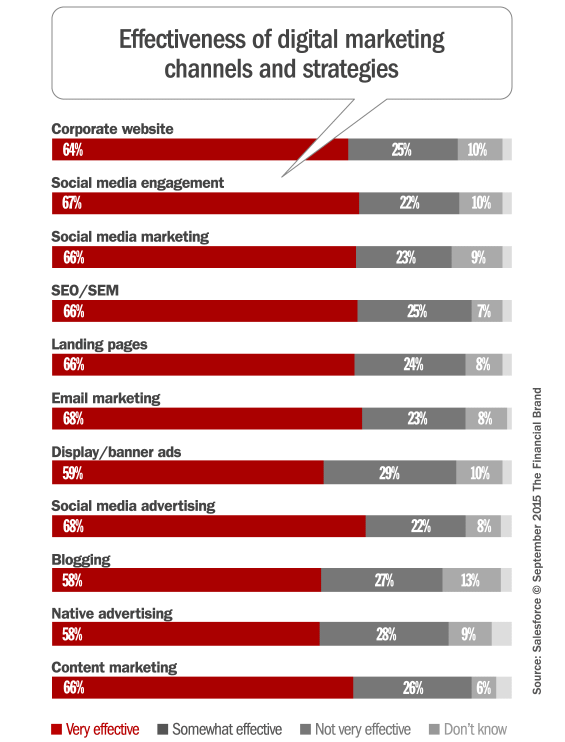

Marketers today have mind-numbing number of technologies, channels, and tactics to choose from. The first step toward a solid strategy is finding focus amid the noise — figuring out what works… and what doesn’t.

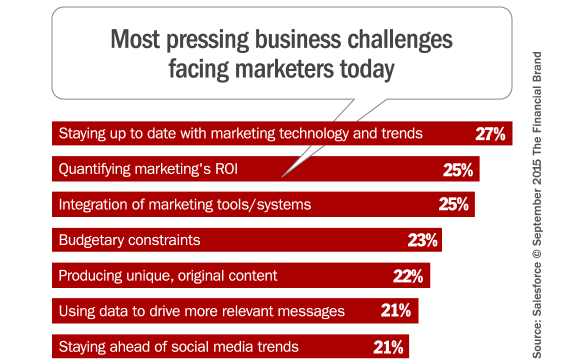

As part of the survey, Salesforce asked marketers to share their top challenges that they face while executing their strategy. Some perennial issues continue to plague marketers, such as budgetary constraints and establishing marketing’s ROI. But among the top concerns marketers worry about most is the need to constantly stay on top off all the new marketing technologies and emerging trends.

The research also revealed some stark contrasts between marketing in 2014 and 2015 — significant changes for such a short period of time. In 2014, the top areas in which marketers planned to increase spend were scattered across multiple disciplines and disparate initiatives. In 2015, the top five areas are all tied to social and mobile channels.

Survey participants said the number-one most pressing business challenge facing today’s marketer is new business development. And where is that new business hiding? On smartphones and tablets, which are increasingly responsible for a bigger portion of consumers’ time spent online.

The Mobile Marketing Imperative

According to the report, 78% of marketers today have integrated mobile into their overall strategy, and 46% rate mobile website or app traffic as the most important mobile marketing metric.

Salesforce cautions that if you haven’t yet integrated mobile into your marketing strategy, you need to get started — now — or it will be too late. With 58% of marketers saying they now have a dedicated mobile marketing team, you’re in the minority if you aren’t headed in this direction.

One of the first steps Salesforce says you should take is to figure out who your internal mobile experts are so you can assess any barriers that may exist between mobile and your other channels. Build a digital team that blends mobile, social, email, and web so you can take a holistic look at how your customers currently interact via mobile as part of the marketing journey.

The Salesforce report singles out two specific mobile opportunities: loyalty and location-based campaigns. Marketers running mobile-based loyalty campaigns say they are extremely effective. Salesforce says that if you don’t yet have a loyalty program, developing one with a mobile-first mindset is the smart way to get started.

They also recommend that you don’t wait any longer to test location-based content. With 67% of marketers planning to substantially or somewhat increase spending in this category in 2015, you risk falling behind if you don’t explore it.

“The consumer appetite for location-based content is there,” says Salesforce. “You just need to discover how your business can respectfully and relevantly use customer locations to create a more cohesive journey in the real world as much as in the online world.”

The Return on Social Media

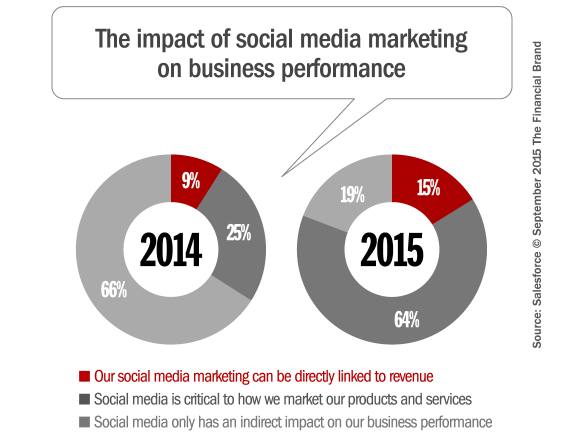

Social media is no longer seen as the fringe marketing outlet that it once was. In the study, 66% of marketers rated social media as core to their business. 78% have a dedicated social media team, up from 57% in 2014.

Salesforce says it’s time to get serious about social, and test new channels. Do your research on channels that might resonate best with your unique audience. Engage in some social listening to see if topics relevant to your brand or competitors are taking place on these lesser-known social networks (they suggest Tagged, for instance).

Salesforce says you need to invest the resources — both headcount and budget — to support social as a viable channel. If you’re not yet seeing significant business results from social, they recommend starting small and focusing on just one platform. What’s the one channel where your social audience is most responsive? Direct more resources to growing that space instead of spreading your efforts too thin.

You should also adopt a round-the-clock strategy. New data shows that consumers are most engaged on social media during weekends — which, coincidentally, is when brands post the least frequently. Designate on-call social managers for every hour of the day, because people interact on their schedule and their own terms when it comes to social media.

“True, you can schedule messages on Facebook and Twitter in advance,” Salesforce points out. “But why schedule posts ahead if no one will be available to reply?” Messages posted to social channels should entice questions and engagement, and few things can frustrate consumers more than a question that goes ignored, especially when the brand posted just moments earlier.

Test what works for your own social audience. Salesforce recommends doing an internal benchmark study. Over a three-month period, track social engagement for time of day and days of week, then see when engagement is typically highest and lowest and focus your social efforts accordingly.

Don’t Overlook Email

With all the glitz and glamour of social media and emerging mobile marketing opportunities, it’s easy to forget about one of the oldest — but still most effective — weapons in the digital marketer’s arsenal: email.

Some argue that there may be a continuing role for email, but it’s importance is waning. Not true; in fact, it’s the opposite. In the Salesforce, study, 73% of marketers said they believe email marketing is core to their business. 60% of marketers in the 2015 survey said that email is a critical component in their strategy vs. 42% of marketers in 2014 — a huge jump in only 12 months.

Salesforce says you need to evaluate email’s role in the customer journey. Subscribers keep their inboxes close, whether in their pocket or an always-open browser tab. Email can guide people through many stages of the customer journey… but first you have to assess and understand the journey you’re currently leading them on.

Ask the following questions as you map your email touchpoints: Are you sending too many welcome messages early on, but too few retention emails? Are your communications steady throughout the journey, or do they appear randomly whenever you’re running a new campaign? How can the email customer journey become more one-to-one instead of one-to-many?

You also need to recognize that your work schedule doesn’t always jibe with your subscribers’ email-reading habits. Consider sending campaigns over the weekend, when subscribers may have more leisure time to peruse their personal email accounts and digest non-urgent messages.

One thing is for certain: your emails must be designed responsively. Salesforce is unequivocal with this advice. Small-screen friendliness must become part of every visual element in your marketing strategy.

In 2014, 42% of marketers “rarely or never” used responsive design in emails. But one year later, only 24% of marketers said they used responsive design “rarely or never.”

Like most marketers, you probably saw a noticeable increase in the percentage of mobile email opens compared to desktop opens last year — possibly even a double-digit increase. Subscribers are voting for responsive design with every click, so if you’re not already designing an easily navigable experience on mobile, it’s time.

Email might have been around longer than social and mobile, but that doesn’t mean your campaigns have to be old-school. Salesforce says you should breathe new life into your email campaigns.

When it comes to email, many marketers don’t test new campaigns, instead relying on old standbys. For example, newsletters are used most often but rank lower for overall effectiveness. Email campaigns with low usage but high effectiveness ratings include abandoned cart (24% use; 93% rate as at least somewhat effective), browse retargeting (24% use; 93% rate as at least somewhat effective), and anniversary (26% use; 91% rate as at least somewhat effective). Some of these campaigns take extra effort to implement, but they may deliver your best email conversion rates.

Try spring-cleaning your email. Send a reengagement campaign that invites subscribers to update their preferences and gain more control over the type and frequency of messages they’re receiving. Make it easy for seasonal subscribers who are interested only in your holiday deals to unsubscribe without resorting to the spam button.